Business Insurance in and around Battle Creek

Calling all small business owners of Battle Creek!

Cover all the bases for your small business

State Farm Understands Small Businesses.

Preparation is key for when the unexpected happens on your business's property like a customer stumbling and falling.

Calling all small business owners of Battle Creek!

Cover all the bases for your small business

Small Business Insurance You Can Count On

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like business continuity plans or a surety or fidelity bond, that can be designed to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Kristin Wykoski can also help you file your claim.

Don’t let the unknown about your business keep you up at night! Call or email State Farm agent Kristin Wykoski today, and discover the advantages of State Farm small business insurance.

Simple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

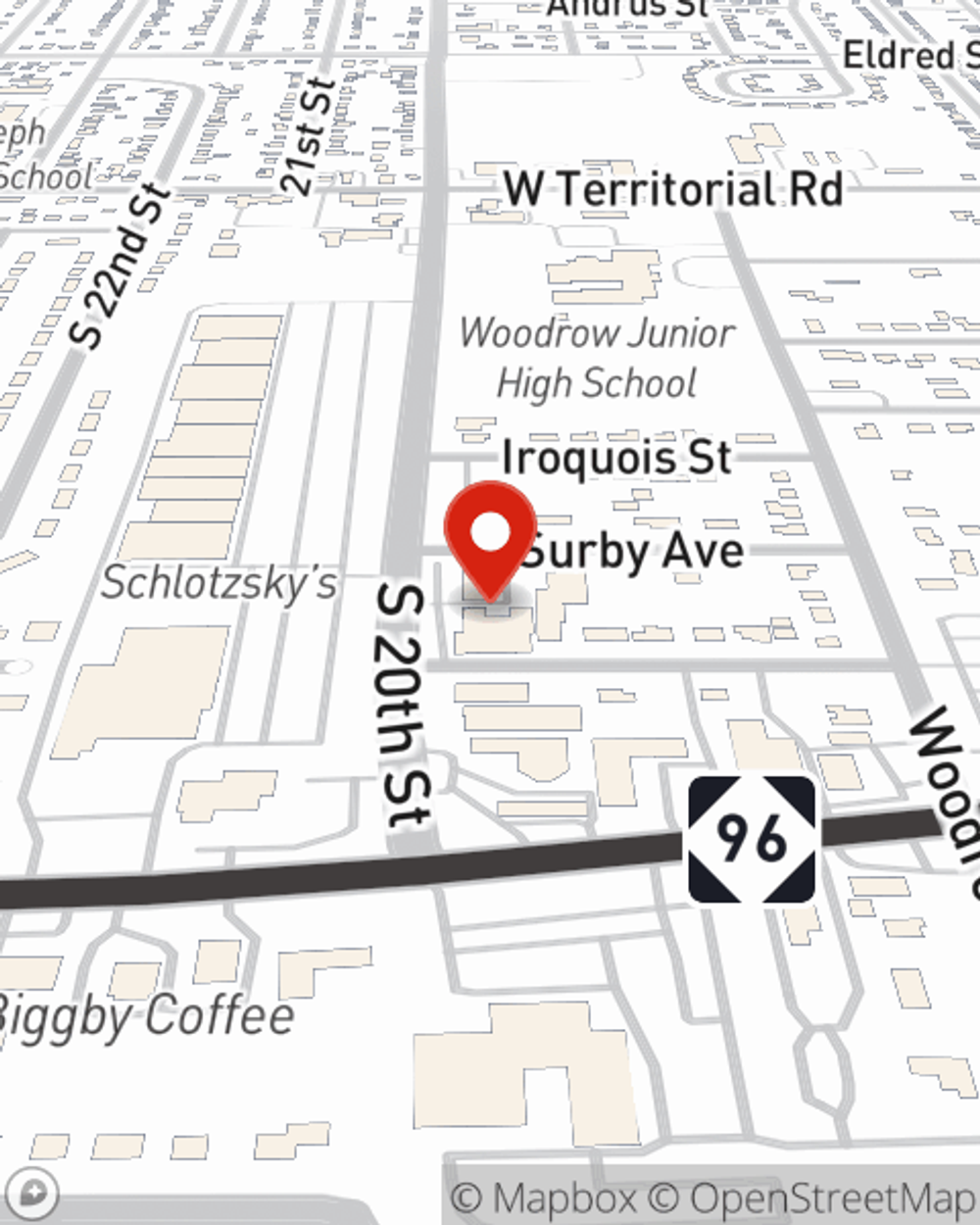

Kristin Wykoski

State Farm® Insurance AgentSimple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.